LOBSTER: high-frequency, easy-to-use and latest limit order book data for your research.learn more.partner.

blog.

Clawing in the Jungle | May 7, 2020

Arnaud Amsellem just publishes an exciting research using LOBSTER data. – Using random forest to model limit order book dynamic go to blog.MathWorks Publishes Machine Learning Applications Using LOBSTER Data | March 19, 2020

https://uk.mathworks.com/help/finance/machine-learning-with-financial-data.html?s_tid=CRUX_lftnav go to blog.Evaluate Trading Strategies by Using LOBSTER Data | March 11, 2020

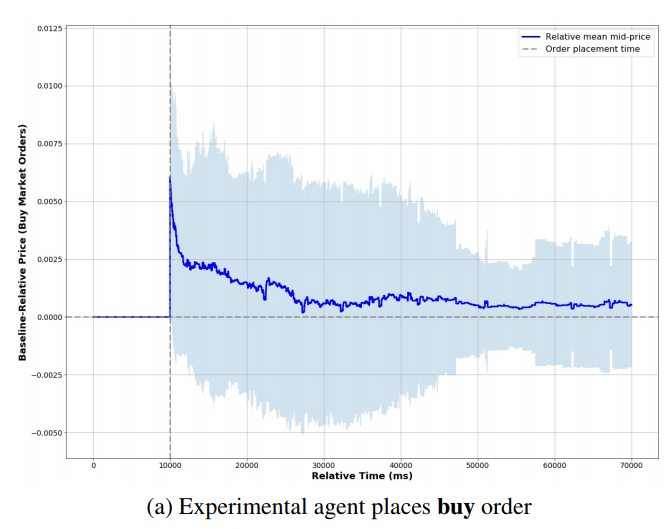

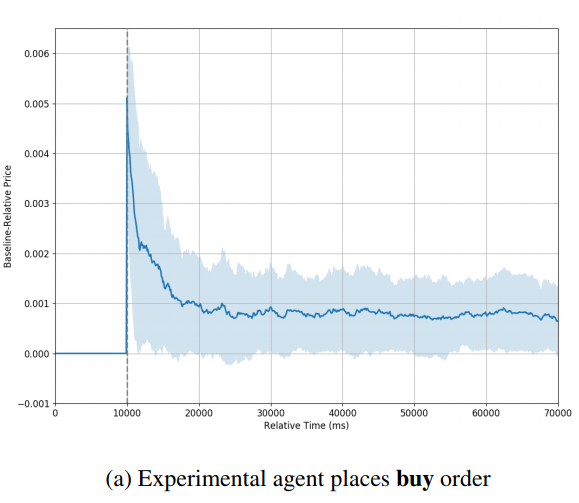

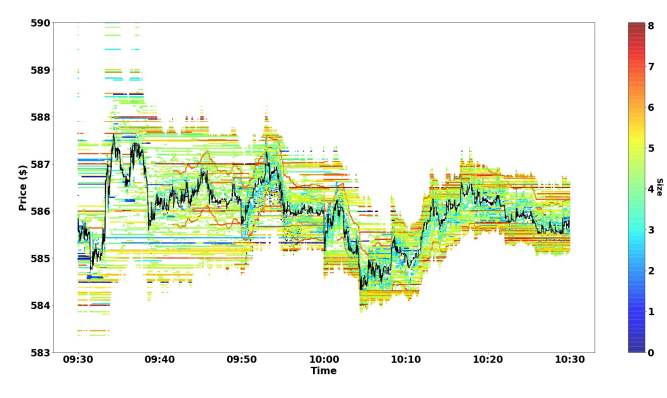

— A short review of a working paper by Balch et.al (2019) from J.P. Morgan Artificial Intelligence Research and Imperial College LondonT.H. Balch et.al have published a working paper, “How to Evaluate Trading Strategies: Single Agent Market Replay or Multiple Agent Interactive Simulation?” In the paper, by using LOBSTER data they show how a multi-agent simulator can support two important but distinct methods for assessing a trading strategy: Market Replay (backtesting) and Interactive Agent-Based Simulation (IABS). In particular, they implement backtesting using three agents: An exchange agent representing the exchange which keeps the order book (e.g., Nasdaq or NYSE), a market replay agent that provides  |

LOBSTER | academic data. - lobsterdata.com - All rights reserved - 2013-2018

|

main. |

resources. |

help. |

partner. |