Although LOBSTER has the capability to generate the entire limit order book, it is currently restricted to a maximum of 200 quote level. As a result a frequently asked question is “Why can’t I generate the whole book?” Besides the data size consideration, the main rational behind this decision is that the liquidity deeply in the book is not likely to be informative.

First, algorithmic traders are not likely to react to deep liquidity, because:

- the market data feed of most of trading platform in the industry do not provide the full book information, and

- it is not optimal for algorithmic trading strategy to react to deep liquidity – Taking advantage of its speed, the algorithm gets enough time to react when the liquidity is showing up close to the market, say in 5 to 20 quote levels. A model taking an action when the liquidity is still hundreds of levels behind the market, disregarding the platform’s low-latency advantage, is clearly sub-optimal (originally, I use adjective “stupid” which is impolite but likely more proper).

Second, the lower frequency traders are incapable to rationally react to deep liquidity, since

- most of them do not have the data feed, and

- a human being can hardly analyse more than ten level quotes in a timely fashion.

Third, the deep liquidity in book is typically from uninformative sources:

- low-frequency traders who lack the capability to monitor the market in real time, and

- the market markers who are obligated to quote on both sides but are not willing to trade on either or both sides.

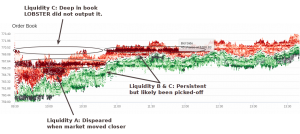

The the above screen shot from Ivo Zeba’s LOBSTER visualisation tool shows the liquidity distribution and price dynamics over a period.

- Liquidity A was closed monitored and could be potentially informative in its first showing-up in the book. Since it was in low levels, LOBSTER outputted it “on time”.

- Liquidity B was in the mid-range in the book, LOBSTER outputted it. But it might not be really informative for price prediction at its first showing-up.

- Like liquidity B, liquidity C was also very persistent and getting picked-off. It had not been outputted at the time of showing-up. However, LOBSTER did output it early enough for its price impact into the consideration for a meaningful model.